Top 50 Craft Breweries and annual Industry Production Report

Annual Craft Brewing Industry Production Report and Top 50 Producing Craft Brewing Companies

The Brewers Association (BA)—the trade association representing small and independent American craft brewers1 —today released its annual production figures for the U.S. craft brewing industry2, highlighting the new realities of a maturing market in a rapidly evolving environment.

Craft brewers produced 23.1 million barrels of beer in 2024, a 4.0% decrease from 20233. However, craft’s market share by volume remained essentially flat at 13.3%, the same share as in 2023, as the overall U.S. beer market* declined by 1.2% in volume.

Employment in the craft brewing sector grew to 197,112 in 2024, a 3.0% increase over the previous year. The rise was driven by the shift toward hospitality-focused models such as taprooms and brewpubs, which create more jobs in local communities.

Craft beer’s retail dollar value rose to an estimated $28.9 billion, a 3% increase over the previous year. This growth reflects pricing adjustments and steady performance in onsite sales, which outpaced distributed sales in many markets. Craft beer accounted for 24.7% of the total beer market in retail dollar sales.

In 2024, the number of operating U.S. craft breweries was 9,612, including 1,934 microbreweries, 3,389 brewpubs, 3,695 taproom breweries, and 266 regional craft breweries. 2024 was the first year since 2005 that the overall number of operating craft breweries declined nationwide. The total number of breweries in the U.S. dropped to 9,680, down from 9,747 in 2023. Over the year, 434 new breweries opened while 501 closed. Although openings declined for the fourth consecutive year—reflecting a maturing and highly competitive industry—the closure rate remained relatively low at approximately 5%.

“In a mature market, not every year is going to be defined by substantial growth,” said Matt Gacioch, the Brewers Association’s staff economist. “While progress may not come in additional production volume, it can still come in honing operations, business practices, and world-class beer. Even in this challenging environment, small brewers have demonstrated that they have the skills and resilience to fight through this period to be better positioned for the months and years ahead.”

Small brewers are already grappling with rising ingredient costs, shifting consumer preferences, and increased competition in a saturated market. Tariffs on imported brewing equipment, steel kegs, aluminum cans, and key ingredients such as hops and malt only exacerbate these financial pressures. These added costs can be particularly challenging for small and independent breweries, which often operate on tight profit margins. As a result, many are forced to delay expansion plans, raise prices, or absorb losses—further compounding the headwinds already challenging the craft beer industry.

“There is still plenty of room for optimism in our industry,” added Gacioch. “Brewers’ proven ability to connect with their customers’ evolving preferences will lead to more opportunities for craft beer success stories into the future.”

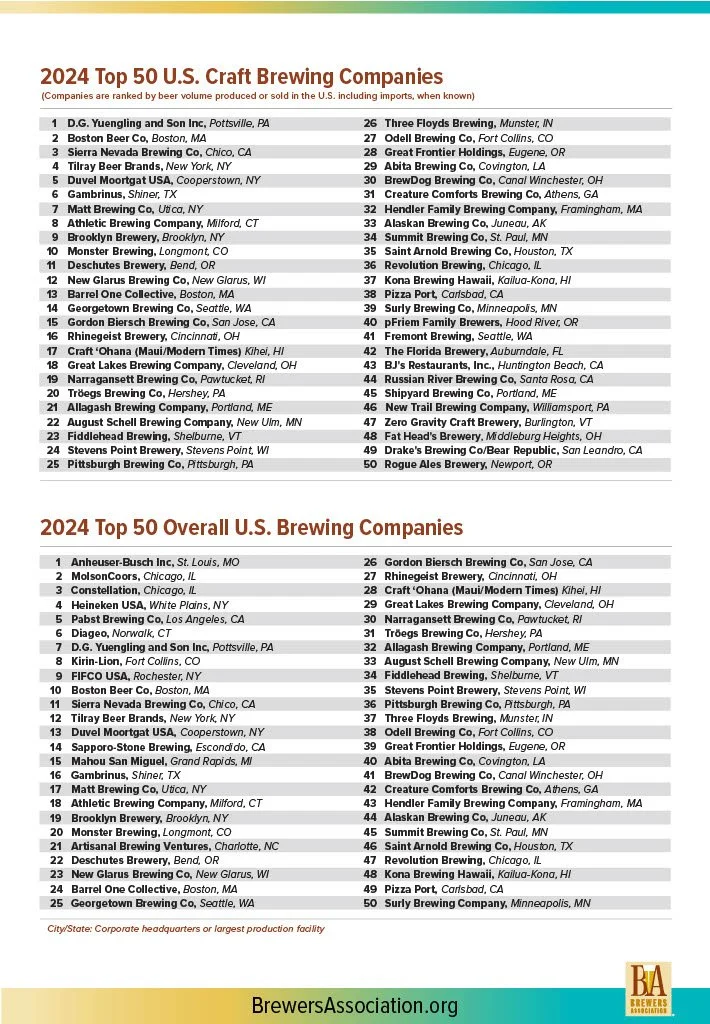

The Brewers Association also published its annual rankings of the top 50 craft brewing companies and overall U.S. brewing companies by beer sales volume. In 2024, 41 of the top 50 overall U.S. brewing companies were small and independent craft brewers.

“While distribution is only becoming more competitive, the top 50 list reflects some of the strongest, most emblematic companies in craft beer,” said Gacioch. “Enduring brands continue to resonate with drinkers—regardless of size or location. In 2024, eight new breweries moved into the top 50 craft list since the year prior—evidence that brewers are still finding ways to lean into what’s working.”