World Beer Market Report reveals the new Top 10 Beer Nations

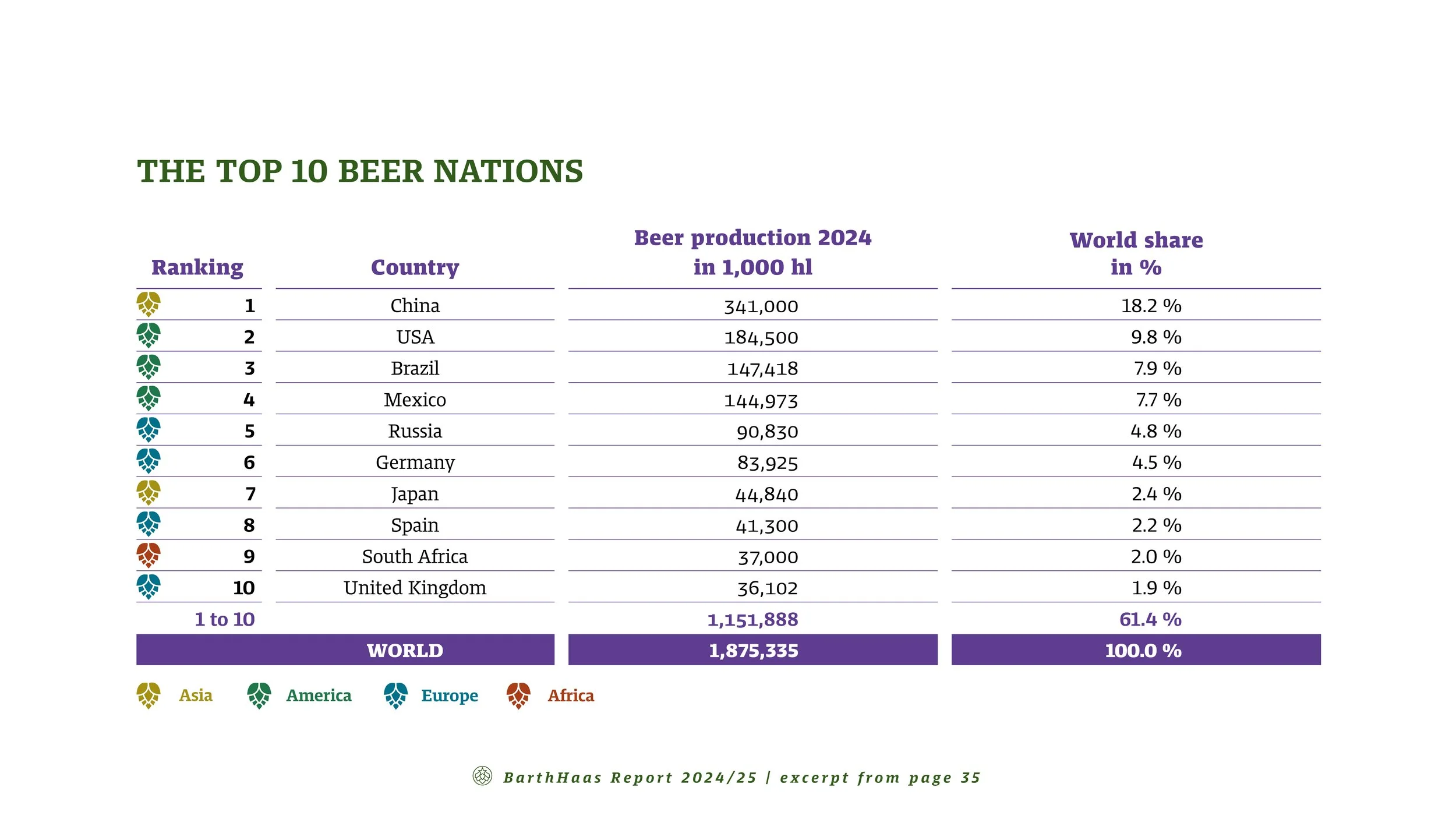

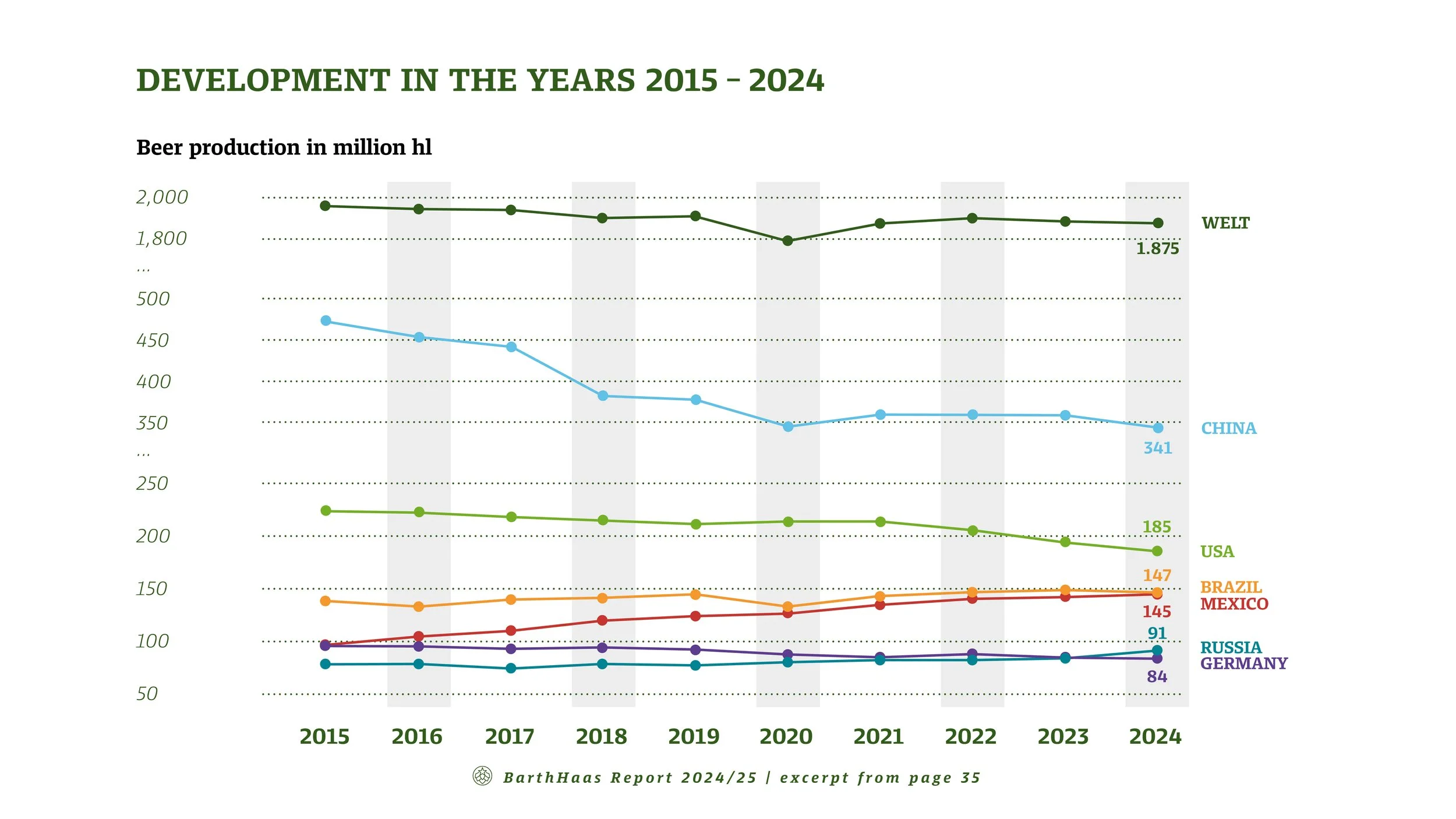

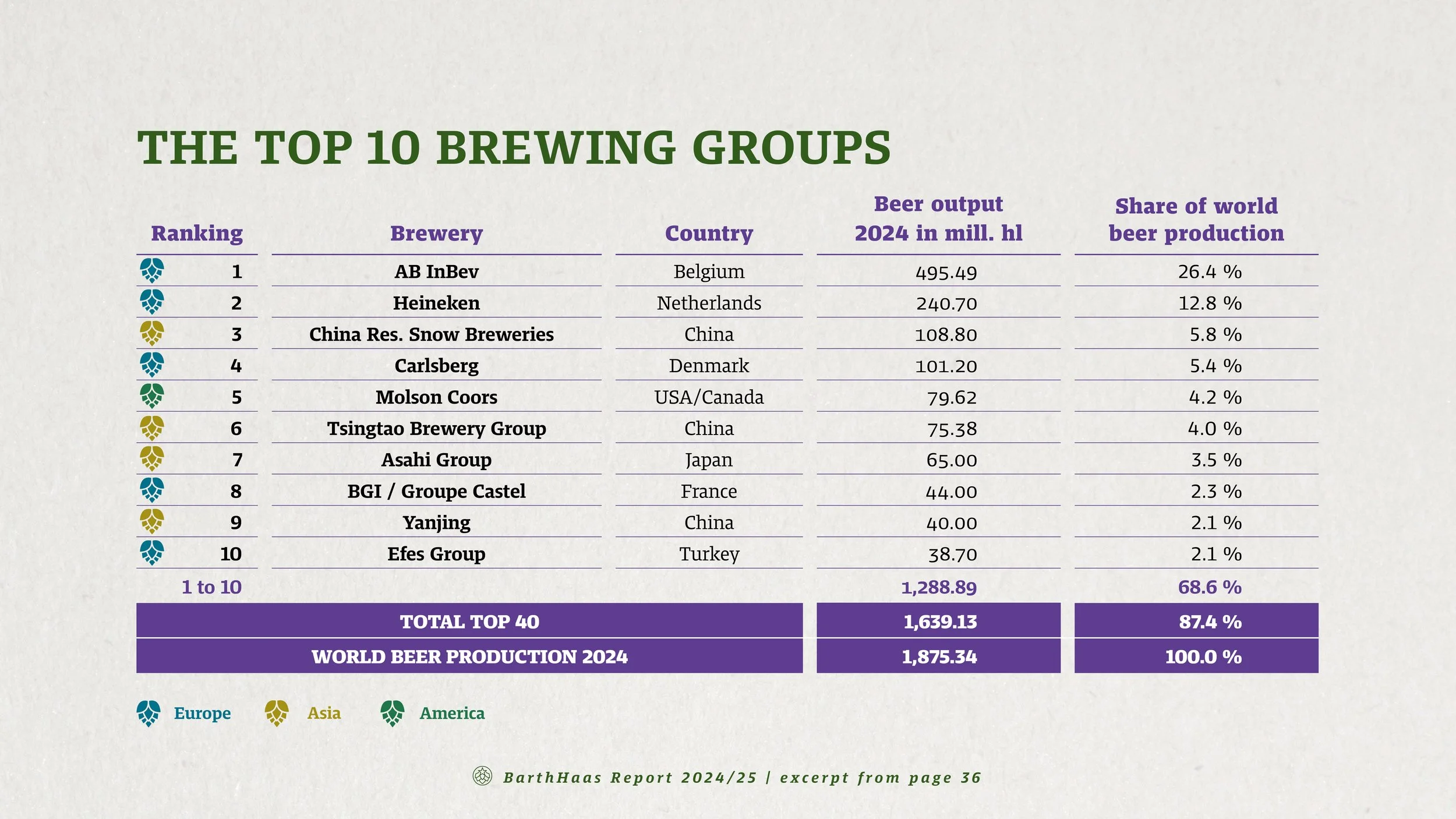

Despite the generally difficult economic environment last year, the brewing industry fared better than expected internationally, says BarthHaas, the global company that is the world's largest supplier of hops and hop products. Comparing 2023 stats against 2024 numbers, global beer production fell only minimally by 0.3 percent to 1.875 billion hectoliters. The newly released BarthHaas Report for 2024/2025 also reveals the Top 10 Beer Nations based on production and analyzes their trajectory over the past decade.

“As is the case in almost all sectors, the beer industry is going through a period of radical change,” emphasizes Thomas Raiser, Managing Director of BarthHaas. “The global crises, with volatile markets, trade wars and, not least, changes in consumer behavior, all present major challenges for breweries, too.” Moreover, the international average hides the fact that individual markets are falling far short of expectations.

Russia dislodges Germany from 5th place

The German brewing industry underperformed the world market as a whole: Beer output in Germany declined by about one percent to 83.93 million hectoliters. “Last year Germany slipped from 5th to 6th place in the international ranking,” explains Heinrich Meier, author of the BarthHaas Report. “This is due to the fact that Russia increased its beer production by about nine percent, thereby overtaking Germany.” In recent years, the two countries had been almost neck and neck when it came to beer output. The first four places are still held by China, the USA, Brazil and Mexico, respectively.

The European beer market registered a slight increase in 2024. In total, beer production increased by 1.1 percent to 514.2 million hectoliters. Declining by 1.0 percent to 339.8 million hectoliters, European Union output did noticeably less well than the rest of Europe, which grew by 5.6 percent to 174.4 million hectoliters. Aside from the increase in Russia, this growth is particularly due to the very positive development in the United Kingdom (+5.6% to 36.1 million hl).

The USA ends the year with a significant deficit

The American continent on the other hand saw beer production in 2024 fall year on year. Throughout the Americas, output declined by 1.3 percent to 617.0 million hectoliters. The decline was particularly evident in the USA, where production dropped by 4.8 percent to 184.5 million hectoliters. Output fell to a small extent in Brazil (-1 % to 147.4m hl), but rose slightly Mexico (+1.8 % to 145.0m hl).

The worst-performing continent of all in 2024 was Asia, where beer output declined by 2.3 percent to 565.4 million hectoliters. This was caused by developments in China, where production fell by five percent to 341 million hectoliters. The world’s number-one beer nation produces a good 60 percent of Asia’s output.

Beer consumption continues to rise in Africa

The world’s highest growth in percentage terms in the year under review was on the African continent. Following a moderately positive development in 2023, beer output in 2024 rose significantly by 6.7 percent to a total of 160.5 million hectoliters. South Africa, the continent’s most productive brewing nation, played a major part in this development, increasing production by 5.4 percent to 37 million hectoliters. In addition, positive developments in Nigeria (+8 % to 19.1m hl), Angola (+35 % to 16.2m hl) and Ethiopia (+8.1 % to 13.7m hl) played a significant role in this.

Australia/Oceania recorded a slight decline last year. Output dropped by 1.6 percent, remaining at a very low level with 18.2 million hectoliters.

It is difficult to make a forecast for the world beer market: BarthHaas expects beer output to remain stable in 2025. However, it will still be anything but plain sailing for the brewing industry. “Aside from the known difficult economic conditions, there is a risk that rising geopolitical tensions and trade disputes initiated by the USA will further depress consumer sentiment and increasingly complicate international trade,” says Thomas Raiser, Managing Director of BarthHaas.

About BarthHaas

BarthHaas is one of the world’s leading suppliers of hop products and hop-related services. The family-owned company specialises in the creative and efficient use of hops and hop products. As visionaries, instigators and implementers of ideas, BarthHaas has been shaping the market surrounding a unique raw material for over 225 years.