Columbia’s acquisition of Point Blank Distributing and what it means for suppliers, accounts & staff

The big news within the Oregon beer and adult beverage industry this month broke on Monday when Columbia Distribution announced they were acquiring Point Blank Distributing (PBD). If you are not working within the industry at a brewery, cidery etc. or a wholesaler or bar, restaurant buyer etc. then you might not understand what the big deal is. Consolidation in the wholesale distribution business is a serious concern as big companies get bigger, forcing out smaller distributors and leaving beverage makers less options and much less leverage. For many this is also a concern about service, there could be less incentive for service if there isn’t another option to get the beverage you want for your bar or store. There is also the question for the makers/suppliers of how well they are being served whether it be from a smaller and lesser-staffed operation, or being lost in an overstocked sea of options at a larger distributor. For a supplier brand it is a bit like a marriage as once they are committed they usually would have to pay a high cost to get out.

Some of the big brands carried by Point Blank that will now theoretically move to Columbia:

Local Breweries: pFriem, Von Ebert, Double Mountain, Boneyard, Barley Brown’s, Everybody’s Brewing, StormBreaker, Wild Ride, Thunder Island, Terminal Gravity, Caldera, and many more.

Cider: Swift, Finnriver, Crispin, Tieton, Apple Outlaw, and many more.

Imports: Weihenstephan, Bitburger, Gaffel, Benediktiner, Andechs, Stiegl, St. Bernardus and many more

Other: Underberg, Aardvark Hot Sauce, Downshift, Ablis, and more.

Many questions remain about the PBD acquisition. We went to the source at Columbia for some answers:

Were Point Blank’s brewery, cidery, winery, soda etc. suppliers notified about the acquisition in advance?

The announcement on Monday, January 26th of Columbia Distributing’s acquisition of Point Blank Distributing (PBD) caught almost every one of Point Blank’s current suppliers by complete surprise. Only breweries that already had relationships with PBD like pFriem and Boneyard appeared to have an early heads up. Multiple other Oregon and Washington breweries confirmed with the New School that they learned about it on Monday along with everyone else and were concerned about what it meant for their business relationships.

According to Columbia: All suppliers are being notified by Point Blank sixty days prior to the transition.

What will happen to Point Blank Distribution?

In the initial Columbia/PBD press release it was announced that Point Blank will operate as a dedicated craft beer division within Columbia, maintaining its craft-first focus. The service model, and contacts are supposed to remain consistent with the same day-to-day service and sales relationships for existing PBD supplier and retail accounts said the announcement.

The New School reached out to Steve Gibbs, Columbia Distributing’s Vice President, External Affairs and Communications to answer some of our lingering questions about the acquisition. Like, does this mean there will be two different teams of sales staff from both Columbia and PBD?

“It is our intent to have the same Point Blank sales force responsible for the Point Blank portfolio. Rather than blending all brands into one large sales force, this model keeps craft brands with Point Blank specialists who understand the unique needs of independent retailers, on-premise accounts, and craft brewers themselves. Across Columbia, we operate distinct divisions where expertise matters—Wine & Spirits, NAB, Red Bull—each led by teams who understand those categories deeply. Point Blank will be treated the same way. Ultimately, each account will be reviewed to determine how to best meet their needs with our specialized sales force which will determine who’s making each sales call,” says Gibbs.

Will Point Blank’s staff be retained by Columbia Distribution?

“That partially depends on the Point Blank staff themselves. Our goal is to retain as many as possible throughout our multiple facilities,” says Columbia Distributing’s Steve Gibbs. “We are working through those details. For example, Jimmy Werbin, who currently leads Point Blank’s sales team, will step into a new role as Business Development Director at Columbia while continuing to lead both sales and portfolio for the Point Blank. Again, our hope is to retain as many Point Blank teammates as possible so that brewers and retailers are working with the same individuals.”

Yet numerous current Point Blank Distribution staff either privately messaged the New School, or left comment on our posts about being laid off or offered severance ranging from $1k to $1.5k to stick around until April when the acquisition is set to close.

This is false according to Gibbs: “We intend to offer positions to the entire Point Blank on-premise sales team and that was communicated to all Point Blank on-premise sales teammates live at yesterday’s meeting. We have also offered a bonus retention incentive to all Point Blank employees to support continuity through close. We won’t be discussing specific details regarding the amount, but the figure cited in that comment understates the incentive offered.”

This response and on multiple occasions Columbia only specifically references retaining PBD’s on-premise team. “On-Premise” is industry lingo for bars, restaurants, etc. where people sit and imbibe in-person on that premise primarily from draft/kegs. On-premise is known as PBD’s strong suit, while Columbia is more focused on packaged beverage in grocery and convenience stores much to the chagrin of many craft beer bars and restaurants that often complain of lack of service or extremely limited delivery windows if they want a keg. When New School followed-up to inquire if PBD’s “off-premise” team would also be offered jobs we were told that Columbia “don’t have anything further to add.”

Adding additional context, sources at PBD have shared that they must re-apply for their positions at Columbia Distributing to be considered. Also, a PBD supplier shared with us anonymously that “They plan on keeping a Point Blank "on premise" team of sort, but no real answers to how many. It did not sound like they were keeping any other staff.”

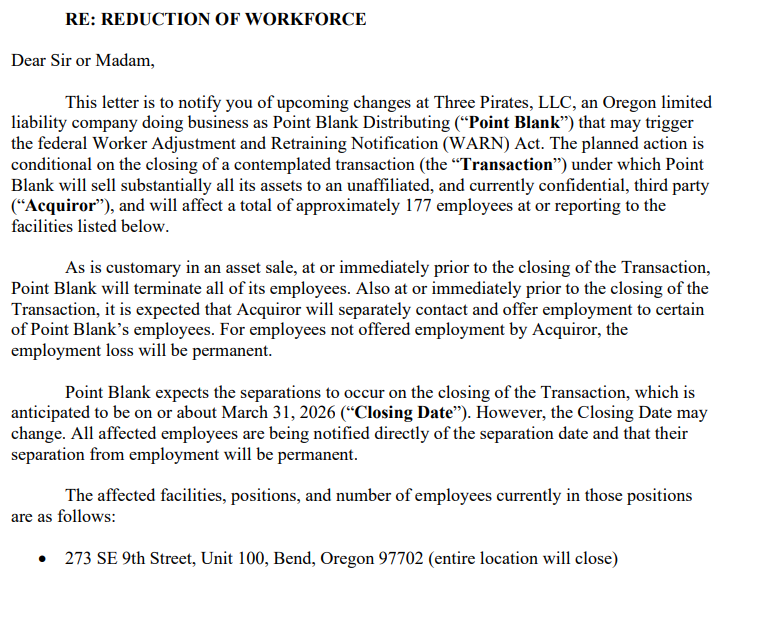

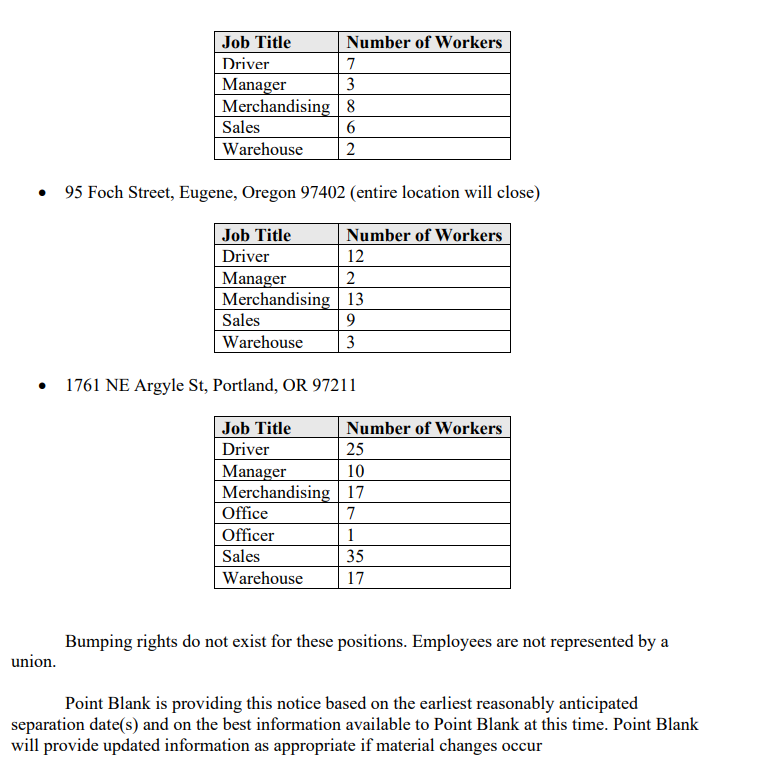

Update: A recently disclosed filing by Point Blank Distributing to Worker Adjustment and Retraining Notification (WARN) on 1/29/26 estimates 177 members of their staff will be let go:

“As is customary in an asset sale, at or immediately prior to the closing of the Transaction, Point Blank will terminate all of its employees. Also at or immediately prior to the closing of the Transaction, it is expected that Acquiror will separately contact and offer employment to certain of Point Blank’s employees. For employees not offered employment by Acquiror, the employment loss will be permanent. Point Blank expects the separations to occur on the closing of the Transaction, which is anticipated to be on or about March 31, 2026 (“Closing Date”). However, the Closing Date may change. All affected employees are being notified directly of the separation date and that their separation from employment will be permanent.”

Will accounts and individuals still be able to visit Point Blank’s office, warehouse and dock sales?

Some of us were still left wondering if Point Blank itself would then cease to exist, fully integrated into Columbia’s massive infrastructure. Educated speculation includes the assumption that the PBD warehouse and service center in N. Portland would likely be shut down, and accounts or individuals looking for draft or package after designated delivery hours would either have to drive to Wilsonville, or be completely out of luck.

A clear answer has not been provided, but according to Gibbs the “intent is to service accounts in a similar fashion as Point Blank to satisfy the specific needs of our craft-centric customers. We do not intend to make dramatic changes to Point Blank’s current service policy.”

Update: Point Blank’s filing to the Worker Adjustment and Retraining Notification (WARN) states that their Eugene and Bend locations will shut down completely and at the homebase in Portland they expect to lay off 25 drivers, 10 managers, 17 merchandisers, 7 from the office, 1 officer, 35 in sales, and 17 in the office.

Will any of Point Blank's current supplier brands be released from their wholesale distributor agreements or otherwise have the option to change distributors?

“We will follow Oregon statute and are in the process of giving all brewers notice. Along with Scott Willis and Jimmy Werbin we will be meeting with brewers and other Point Blank suppliers in the coming weeks. We do not believe in holding brands hostage and will work with them through the transition,” says Gibbs.

Oregon State Statute (ORS 474.011 ) limits when, how, and on what basis a brewery/cidery/winery can terminate a wholesale agreement. In general the supplier must pay a 3x multiplier of their annual gross sales to get out of an agreement within Oregon’s three-tier-system. It is technically possible to leave an arrangement provided that the supplier provide 90 days notice and must show that the distributor violated a term of the agreement that was a material term of the agreement to get out of a contract without penalty. Even still, the brewery must act in good faith and allow the distributor a 60 day window in which to remedy the conduct or omission that the brewery argues constitutes breach according to Engrav Law Office.

Though not stated verbatim, this seems to indicate that Point Blank’s suppliers will be offered to buy themselves out or continue distribution through Columbia moving forward.

“If you are evaluating options, I would say that from the Point Blank wholesale agreements I’ve looked at, the Assignment, Termination Clauses, and Assignment clauses are very important to carefully review (preferably with counsel). Depending on your agreement, these terms may supplement the statute and might even shorten response timelines,” says Engrav Law partner Grant Engrav.

In Oregon there are only a few smaller independent beer distributors now remaining: Day One Distribution, Upstanding Distribution, and Block 15 Distribution which may have opportunities to pick-up PBD suppliers that are roaming.